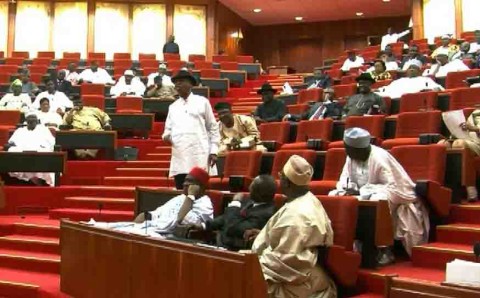

Senate Okays N59.7bn Bond for 2nd Niger Bridge, Adjourns till After Presidential Election

Featured, Latest Headlines, National News Tuesday, March 17th, 2015

Ayodele Afolabi, Abuja – Senate has approved N59.7 billion diaspora bond to be borrowed from the International Capital Market for the construction of key capital projects in priority sectors of the economy, including: the Second Niger Bridge, the Lagos-Ibadan Expressway and the Infrastructure for the Abuja Mega City.

This is Just as the Senate has adjourned plenary till the 31st day of March this year, to enable senators participate in the electioneering campaigns of their respective political parties.

Approval of the N59.7billion diaspora bond by the Senate, followed the adoption of the report of its Joint Committees on Local and Foreign Debts and Finance, which increased the amount to be borrowed from the international capital market from N19.9 billion to N59.7 billion.

President Goodluck Jonathan had through a letter to the Senate President, David Mark, requested the Senate to increase the amount to be borrowed through the Diaspora Bond from the International Capital Market from N19.9 billion to N59.7 billion.

According to the report of the Joint Senate Committees, the increase will accommodate a greater number of Nigerians in the diaspora who has interest to invest in the development of the country.

The report noted that provisions of sections 41, 42, 44, and 47 of the Fiscal Responsibility Act 2007 prescribed conditions for borrowing and verification of compliance limit which the joint committees considered and gave approval for the fund.

The committees said before giving the approval, it had several meetings with the Director General of Debt Management Office, as well as giving a critical consideration of the Medium Term Debt Management Strategy, 2012-2015 published by Debt Management Office.

It also said it considered the Fiscal Responsibility Act, 2007, the Debt Management Office Act, 2003, and the 2014-2016 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).

Meanwhile, the committee said the diaspora bond is necessary to create more space in the domestic market for other borrowers particularly private firms.

While observing that the approved N59.7 billion is consistent with the Public Debt Management Strategy, it also said with the dwindling oil revenue, it has become imperative to diversify the sources of funding the government.

Related Posts

Short URL: https://www.africanexaminer.com/?p=22790