OPINION: Nigeria Turns Corner With FG’s Mandatory Implementation of NIN, BVN

Articles/Opinion, Latest Headlines Tuesday, December 19th, 2023

(AFRICAN EXAMINER) – The disappointing execution of the Conditional Cash Transfer (CCT) scheme of the Federal Government is largely linked to the unsatisfactory implementation of the National Identification Number (NIN) on which our development as a nation hinges.

The World Bank-backed CCT has been widely criticised for lacking in transparency, especially under the immediate past President Muhammadu Buhari-led government; but the present government under President Bola Ahmed Tinubu has vowed to refocus and rejig the scheme in the most transparent manner.

In 2016, the Federal Government of Nigeria and the World Bank collaborated to establish the National Social Safety Nets Coordinating Office (NASSCO) to improve Nigeria’s social safety nets and social protection system to end severe poverty among the people, upgrade their standards of living and improve the economy.

Towards this objective, the World Bank offered a credit of $500 million to support the social safety net programme, which was to end by June 2022 but was extended to December 2022 due to some payment delays.

Also, the World Bank approved another $800 million to scale up the programme to 2024, and it is one of the fuel subsidy palliatives of the current administration.

In honour of the 2023 International Day for the Eradication of Poverty, President Tinubu recently inaugurated the disbursement of N25, 000 to 15 million households for three months as a social safety net initiative.

Achievement in reverse

However, it has been observed that a significant number of poor and vulnerable people may be excluded from the Federal Government’s cash transfer programme, as the World Bank disclosed that less than one per cent of them have their National Identity Number (NIN).

It was established that the number of individuals registered in the National Social Registry with a valid national ID number from the National Identity Management Commission (NIMC) was 20 per cent by June 30, 2022.

However, as of December 31, 2022, only 0.10 per cent of the total poor and vulnerable Nigerians on the registry had NIN.

Reports revealed that the main reason for the failure to hit the target, was that the expansion of the National ID was very slow and beyond the control of the program. As a result, officials used other means to verify the identity of the beneficiaries collecting the CCT and this led to corruption as the process was massively compromised.

The Federal Government is now reviewing and expanding the National Social Register and will disqualify those without NIN and Bank Verification Numbers (BVN). It means that out of the 9.67 million (9,666,420) total beneficiaries of this project, only about 9,670 persons have NIN.

There is a likelihood that about 9.66 million poor and vulnerable may be excluded from the registry if they fail to get their NIN and BVN.

This shows that about 15 years since the NIN was launched, the scheme is yet to capture a large population of the citizens due to several factors particularly incompetence and corruption.

For effective implementation, the Federal Government has determined to part with the old ways of the CCT that lacked transparency by insisting that only those who have their NIN and Bank Verification Number (BVN) will be considered for the CCT.

Incidentally, a section of the nation’s leadership seems determined to scuttle the process by arguing that insisting on NIN and BVN will slow down the process and disqualify a large number of the poor and vulnerable people for whom the scheme is meant.

This is the time to revisit the slow and poorly coordinated NIN registration scheme which has put many people at a disadvantage for obvious reasons.

Imperative of NIN

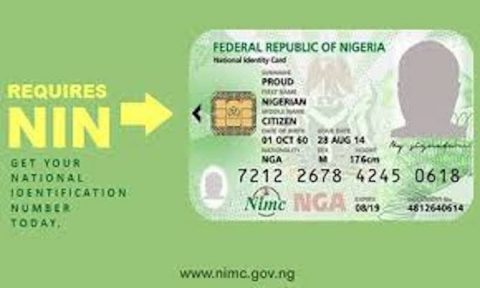

The National Identity Management Commission (NIMC) Act, 2007, which was gazetted to put into effect the mandatory use of the National Identification Number (NIN) Regulations, stipulated the application of the NIN in our various spheres of life. The importance of NIN is underscored by the fact that it serves as the social security to the citizens.

Section 27 of the NIMC Act stipulates the detailed use of NIN in our individual and collective activities, to include

Registration for and provision and use of hospitality services;

Registration and licensing for and use of health or medical services’ Application for the adoption of an infant, child or person under applicable Laws;

Purchase and registration of Aircrafts, Ships, Boats, Motor Vehicles and Motorcycles;

Change of ownership of aircrafts, ships, boats, and motor vehicles and motorcycles;

Registration and use of aviation services by airline operators and customers;

Purchase of travel tickets or tokens for air, rail, road and water transportation;

Boarding of aircrafts, trains, commercial vehicles, ships and boats;

Registration for and purchase of insurance policies;

Acquisition, sale or transfer or transmission of shares or equities and other financial instruments;

Purchase of travel tickets or tokens for air, rail, road and water transportation;

Boarding of aircrafts, trains, commercial vehicles, ships and boats;

Registration for and purchase of insurance policies ;(j) acquisition, sale or transfer or transmission of shares or equities and other financial instruments’ among others.

The vital nature of the NIN is that it is used to tie together all records about the person’s – demographic data, fingerprints, head-to-shoulder facial picture, other biometric data and digital signature – in the National Identity Database making it relatively easy to confirm and verify your identity when you engage in travels and transaction.

As has been established, this vital feature of the NIN makes it pivotal for all citizens (home and abroad) as well as legal residents of Nigeria to endeavour to obtain their unique NINs as soon as they can.

Although over 100 million Nigerians linked their NIN with their mobile phone SIM within three years, the issuance of the NIN has been marred by delays and extortions despite efforts by the NIMC. There were several reports of a technical hitch in the NIN verification portal, especially in 2022. The new management of NIMC under Abisoye Coker Odusote appears to have fixed the hitches.

I counsel the NIMC to step up its campaign for NIN registration and collaborate with the telecom providers to deepen the penetration to the rural areas where the most vulnerable live.

Collaboration with licenced Payment Service Banks as well as commercial banks and registered agents can rapidly improve new NIN and BVN registrations and reverifications.

* Mike Abbah, a public affairs commentator, writes from Lagos.

Related Posts

Short URL: https://www.africanexaminer.com/?p=92900