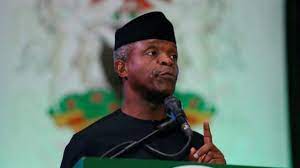

Nigeria’s Vice President Yemi Osinbajo Tasks African Insurance Coys On Climate Change

African News, Business News, Latest Headlines Thursday, January 20th, 2022

(AFRICAN EXAMINER) – Nigeria’s Vice President, Prof. Yemi Osinbajo has urged key players and stakeholders in the insurance industry in Africa to brace up to the challenge of addressing damages arising from climate change across the continent.

Prof. Osinbanjo gave the charge at the closing of the 2021 Conference of African Insurance Practitioners, with the theme, “Rebuilding Africa’s Economy: An Insurance Perspective”.

He urged African insurance practitioners to leverage opportunities in the African Continental Free Trade Area (AfCFTA), which according to him, offers great opportunities for Africa’s socio-economic transformation.

“How is the African insurance industry preparing for the interesting days ahead? While there will obviously be opportunities for new insurance products and solutions, especially in the property and casualty segment of the business, insurance companies must also be prepared for the systemic nature of climate induced damage, with the possibilities of market failures and more system-wide destabilization.

“Here in Nigeria, the growing intensity of flooding and damage to vast agricultural acreages might have a knock-on effect on other areas of the economy. Further slumps in the economy are bad for everyone, even insurers. Every smart economic grouping, whether governments or businesses, must be thinking, planning and strategizing for these new times”, he said.

The VP noted that the free trade agreement presents a major opportunity for African countries, adding that by some estimates, if we get it right, a huge population will be lifted out of abject poverty across the continent.

“If we get it right, we can bring several millions out of extreme poverty and raise the incomes of 68 million others who live on less than $5.50 per day. There are potential income gains of up to $450 billion, and just cutting red tape and simplifying customs procedures alone could drive up to $250 billion of that sum. So, what does all this mean for the insurance industry in Africa?

“Well, plenty of opportunities. More trade in goods will mean greater need for insurance services, brokers, in particular, should expect a boom; demand for trade facilitation services will rise, but obviously companies that already have market presence in other African countries, even if by collaboration, will benefit more than others”, he added.

Prof. Osinbajo further explained that “we can expect to see more well capitalized insurance providers from other African countries coming to compete in the Nigerian market. And we shouldn’t be surprised if this happens quickly”.

He said services can be set up faster than manufacturing plants, adding that Nigerian financial services companies, especially banks, are already in many African Countries, the likes of Zenith, Access, United Bank for Africa (UBA). “How about Insurance companies? We should now be looking at developing homegrown international African insurance conglomerates. The time is now”, he stressed.

In a statement by his spokesman, Laolu Akande, the VP noted that there is perhaps a more significant climate change challenge for the African continent.

“In the past two years, the wealthier countries, after building their own economies on fossil fuels, are now banning or restricting public investments in fossil fuels, including gas. Seven European countries, including France, Germany, and the United Kingdom, announced that they would halt public funding for certain fossil fuel projects abroad.

“Also, the World Bank and other multilateral development banks are being urged by some shareholders to do the same. The African Development Bank, for instance, is increasingly unable to support large natural gas projects. Already, some OECD based insurance companies are already committing to reducing their commitments to carbon intensive industries by 2030”, he further stated.

Prof. Osinbanjo also observed that considering the implication of the trend on Africa’s growing oil and gas markets, it is imperative that insurance companies operating in the continent lend their voice to the narrative.

“I think African insurance companies must now speak and act differently. You must be at the forefront of the campaign for a just and equitable transition to a low carbon future. This means that we cannot accept a defunding of gas projects when gas is an important transition fuel for us. Not just to get our people from the environmentally damaging firewood to cooking gas, and also autogas for our auto vehicles, but to also provide much needed power for industries and domestic use.

“Africa’s economic future might really be at risk if we do not find our voices and, in unison, insist that the necessary speed to zero emissions must not mean disaster for our African economies”, he warned.

Related Posts

Short URL: https://www.africanexaminer.com/?p=72973