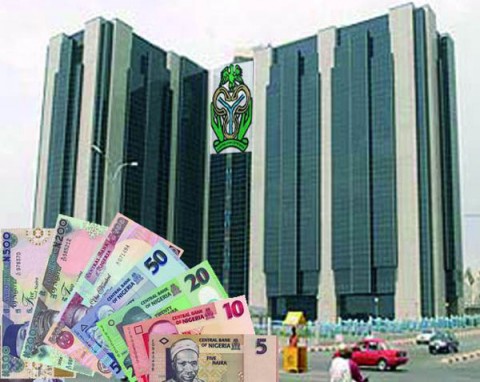

CBN Increases Interest Rate To 22.75%

Business News, Latest Headlines Tuesday, February 27th, 2024

(AFRICAN EXAMINER) – The Central Bank of Nigeria (CBN)’s Monetary Policy Committee (MPC) has raised the Monetary Policy Rate(MPR) by four hundred basis points to 22.75 percent from 18.75 percent.

Governor of the CBN Yemi Cardoso announced this after the first MPC meeting for the year in Abuja on Tuesday.

“All 12 members of the committee decided to further tighten monetary policy by raising the MPR by 400 basis points to 22.75 per cent from 18.75 per cent. Adjust the asymmetric corridor around the MPR to +100 to -700 from plus 100 to -300 basis points,” he said.

The MPR has been 18.75 percent since the last MPC meeting between 24th and 25th July 2023.

With inflation at 29.90 percent, he said the new MPR is part of moves to tackle the country’s inflation.

Cardoso who chairs the MPC also said the Cash Reserve Ratio(CRR) has been raised to forty-five percent while the liquidity ratio was left unchanged at thirty percent.

The CBN chief also said over $26 billion has passed through the crypto app Binance Nigeria in the last four years.

“In the case of Binance, in the last one year, 26 billion dollars has passed through Binance Nigeria from sources and users who we cannot adequately identify,” he told reporters in his first MPC meeting since assuming office as the CBN governor.

Economic hardship in the country has worsened in the past months, leading to protests in several parts of Nigeria.

But Cardoso has exonerated himself and his team from the country’s economic woes.

“I laugh at that question but it’s not a laughing matter and I think it is very important for Nigerians to understand that the Central Bank Governor — I and my team — are not responsible for the woes that we have today; we are part of the solution,” the former Lagos State Commissioner for Economic Planning and Budget said while responding to a question on how the CBN intends to tackle the country’s biting economic hardship.

“We are determined to ensure that we work hard to get out of the mess that Nigeria is in. We assumed responsibility in a time of crisis of confidence; there was a crisis of confidence and you may all want to go to bed and wish that crisis of confidence was not there but it was, and we can’t turn back the clock.

“All we can do is do the difficult things to make a bad situation better and I do believe that the efforts that we are making are beginning to bring back confidence because to be frank, without confidence in your business, you are not going to get far.”

Related Posts

Short URL: https://www.africanexaminer.com/?p=94133