Bridge Concept Leverage UBA Digital Banking Platforms, Introduces Naija Green Card

Banking & Finance, Business News, Featured, Latest Headlines Thursday, June 8th, 2017

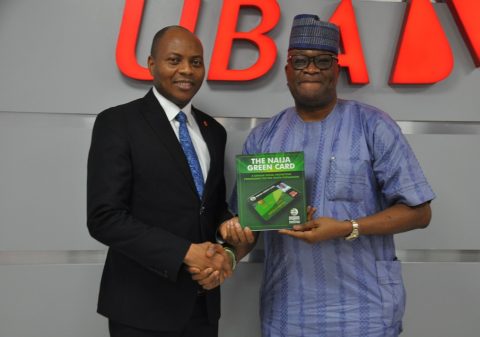

Photo caption: L-R: Founder Naija Green Card, Abimbola Daramola and Head Digital & Consumer Banking, United Bank for Africa (UBA) Group, Mr. Yinka Adedeji, during the official launch of the Naija Green Card Prepaid Card at the UBA house, Lagos

(AFRICAN EXAMINER) – In line with its business objective of enabling young Nigerians and students to derive maximum benefits from their limited finances, Bridge Concepts Limited has announced a partnership with the pan African Financial institution, United Bank for Africa (Plc) with the introduction of co-branded discount cards known as the Naija Green Card, the first of its kind discount payment solution.

The Naija Green Card powered by UBA, is a chip and pin prepaid card to be used at Point of Sales (POS), online stores and merchant locations within and outside Nigeria. It would enable young Nigerians including students to enjoy exclusive discounts on products and services with over 10,000 merchants’ across the country.

The Naija Green Card designed as a social safety instrument for young Nigerians, students and youth corp members on national assignments, will enable access to substantial discounts on products and services, ranging from electronics, restaurants, transportation, medical needs, insurance, entertainment to fashion, education, etc.

Speaking on the innovative partnership, the Founder/ Initiator, Naija Green Card, Mr. Bimbola Daramola said his company is delighted to partner with UBA Group on the initiative because of the bank’s presence in multiple geographies on the African continent and also its pedigree as the most innovative bank in the digital banking space in Africa. “UBA remains the most thriving institution capable of advancing our course in ensuring the discount culture takes root on the continent, especially as Bridge Concepts Limited plans to extend its business around the world,” Daramola said.

Daramola also noted that “with the Naija Green Card initiative, Card Holders would be able to purchase various brands of goods and services from a large pool of local and national businesses at a discount ranging from 5% to 50% or even more, depending on the service provider or product seller”.

“As it stands today, we have put more than 10,000 businesses both growing and established at the behest of students and customers. This partnership seeks to curb challenges faced by consumers through the maximisation of resources, thus increasing their purchasing power,” Daramola said.

Also speaking, Head, Consumer and Digital Banking, Yinka Adedeji said the partnership couldn’t have come at a better time considering the economic situation in the country that has significantly affected the purchasing power of consumers.

“Without a doubt, the move will help alleviate the current challenges as well as improve the living conditions of young Nigerians, students and NYSC members to enable them get better bargains on their needs with little funds so that they can achieve more”, Adedeji said.

Related Posts

Short URL: https://www.africanexaminer.com/?p=39600