Access Bank Renews Pledge To Promote Women Entrepreneurs In Nigeria

Business News, Latest Headlines Saturday, April 2nd, 2022

(AFRICAN EXAMINER) – Access Bank, a Nigerian multinational commercial bank has reaffirmed its commitment to support women and contribute to the growth of the women-led businesses in Nigeria.

The need to increase the opportunities for women-led businesses to access new markets, increase profit and expand their businesses has remained an important focus for Access Bank through its women’s market programme – the W Initiative.

The W Initiative is the platform for everything the Bank has to offer women across all career and life stages.

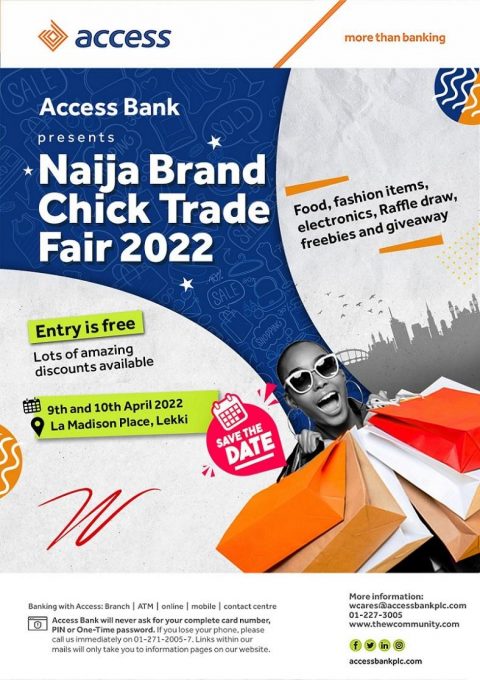

In fulfilling this objective, the Bank has partnered with foremost Nigerian female entrepreneur and business strategist, Nelly Agbogu to organize the 5th edition of the Naija Brand Chick Trade Fair.

The two-day fair, is scheduled to hold at La Madison Place, Lekki, Lagos on April 9th and 10th and is expected to drive over 20,000 visitors with hundreds of female entrepreneurs exhibiting their products and services during the fair.

As part of its commitment to investing in women-owned businesses, all female businesses affiliated with the fair would be given free capacity building training sessions to equip their financial literacy and build business competencies.

Access Bank has been a strong supporter of the Naija Brand Chick Trade Fair having served as the exclusive financial partner and headline sponsor of the Fair since 2019.

Access Bank Group Head, Women Banking, Abiodun Olubitan said the Bank truly appreciates the importance of supporting female entrepreneurs and their role in the business sector of the economy.

“We understand the importance of contributing to the growth of the economy by providing business yielding opportunities for women-owned businesses. We believe in the vision of today’s female entrepreneur, and we are willing to help her grow. Accessing new markets is one of our growth strategies and this partnership has indeed contributed to scores of women entrepreneurs expanding their profit and business portfolio through physical trade exhibitions and fairs.

“Through the W Initiative, women-owned businesses across Africa can now access business growth opportunities through discounted financing such as the W Power Loan and capacity building programs like the Womenpreneur Pitch-a-ton and IFC certified Mini MBA”, she said.

Similarly, the Bank’s Group Head of Emerging Businesses, Ayodele Olojede, noted that supporting the growth and development of Micro, Small and Medium Enterprises (MSMEs), is a core proposition for the Bank because, according to him, they understand their contribution to the economy in terms of Gross Domestic Product (GDP) and Employment.

“However, we also know the challenges business owners face and we have developed our proposition to alleviate the constraints. Furthermore, we have also digitized this solution to ensure that we can cater to the vast majority of MSMEs. Some of these innovations include our online account opening platform for businesses, digital lending platform, Digital payment solution platform (Swiftpay), Access to market (Discounted Website), and our capacity-building programmes”, he further explained.

Related Posts

Short URL: https://www.africanexaminer.com/?p=75330